Mon-Fri 9am-5pm Eastern Standard Time

866-860-1860

info@sourcecapitalconsulting.com

Fact Sheet

Land Purchase and Development Project

Parkside Place, Orlando Florida

Primary Principal

Alex Headley

Rodney Koch

Project Name

Parkside Place Orlando Florida

Funding Requested

We're seeking a JV equity partner to contribute $53,500,000 USD, disbursed over three structured tranches

1. Immediate Need: $8,000,000 USD to be directed immediately to our escrow attorney. This will cover the initial deposit and associated soft costs leading up to the closing.

2. Land Acquisition: $22,000,000 USD to finalize the land purchase and cover closing costs. The funding can be structured as debt, equity, or a hybrid of both. Our partner has the opportunity to secure a first position against the land, currently valued at $50,000,000 USD.

3. Infrastructure Development: $23,500,000 USD is earmarked for horizontal construction, laying the foundation for the subsequent vertical developments.

Payback Schedule

We are currently positioning this venture as a strategic land bank. Our financial projections and strategies allow us to confidently anticipate a full repayment to our primary lender within a 15-month timeframe from our acquisition date.

We will have hard deposits in hand from our land bank buyers within weeks of our deposit money placed in escrow. We will sell the parcels as soon as the horizontal construction is completed and close all within 15 months. Will pay off the loan from the lender, in the same phases as we complete the parcels.

Collateral

First position in land once purchased.

Return for investor

Investment and Return Structure

For the $8.0m Tranche:

Interest: A preferred simple interest of 10% on the borrowed amount.

Equity Participation: Investors will receive a 10% equity share in the profits from land bank sales.

For the $22.0m Tranche:

Interest: A preferred simple interest of 10% on the borrowed amount.

Equity Participation: Investors will benefit from a 20% equity share in the profits from land bank sales.

Additionally, there will be a 5% equity share in profits from vertical sales.

For the Comprehensive Package of $53.5m:

Return on Investment: 10% on the total cash invested.

Equity Participation: Investors will obtain a 30% share in profits from the land bank sales.

On top of this, there will be an additional 15% equity share in profits from vertical sales.

Projected Financial Overview:

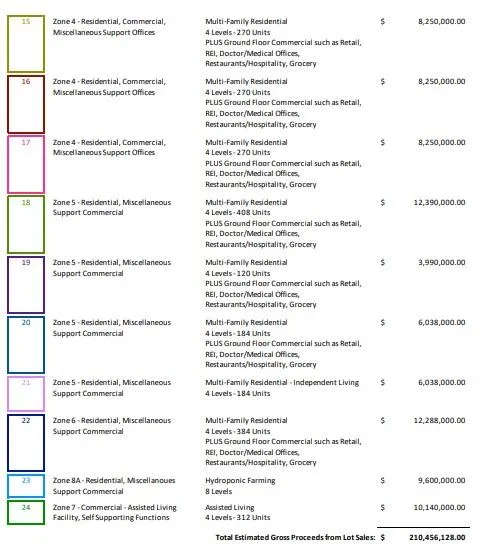

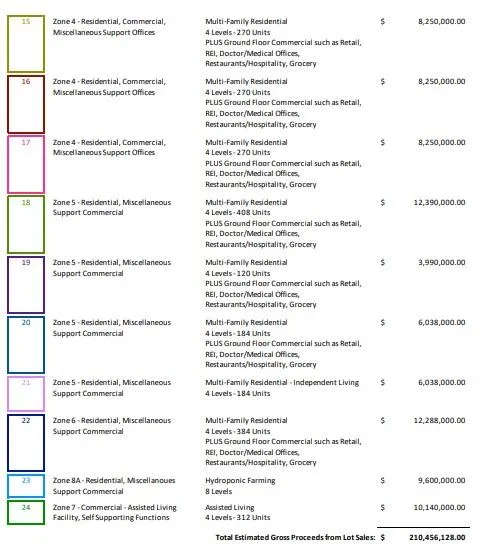

Based on our proforma, we anticipate approximately $210m USD in gross land bank sales, translating to an estimated profit of $150m USD to be shared among partners.

Management Team

KEY CONSIDERATIONS

Commitments from land sales in place to payback the primary lender in 15 months from acquisition.

Healthy ROI on invested capital and upside equity participation in horizontal and vertical buildout of the project.

Project Summary

Parkside Place Orlando Florida

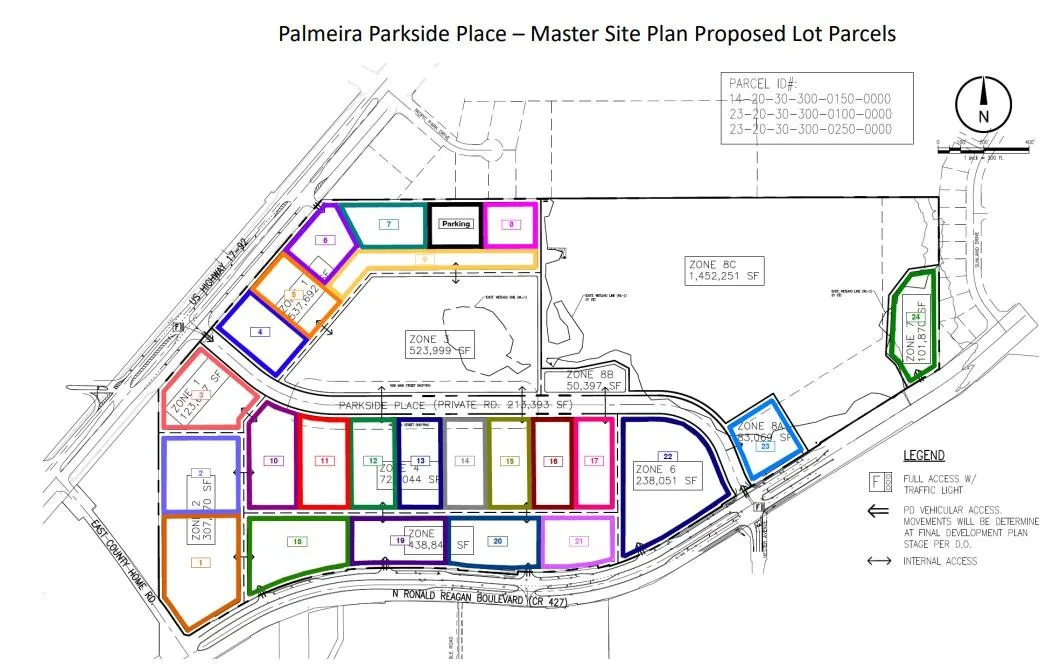

TW International Investments, LTD ( BVI F.O. ) has a purchase agreement in place with land (total of 110 acres, 77 acres are in the development plat for 24 parcels with a mix of Hotel, student housing, residential and commercial all with verbal commitments on takeout agreement from us, with contracts to follow as soon as we close on the land). The move to closing will commence as soon as the performance bond is in place.

We have approximately $89m in commitments from TW's long-term partners ( CALPERS, Toll Brothers, Marriot flagged hotel are some examples) as soon as we have the land transferred to us, we will have confirmed contracts for that. We have approved planned development (PD) plans with the local authorities. Our management team is in place and has many years of experience in land development. https://palmeiraholdings.com/#team ).

We will have hard deposits in hand from our land bank buyers within weeks of our deposit money placed in escrow. We will sell the parcels as soon as the horizontal construction is completed and close all within 15 months. Will pay off the loan from the lender, in the same phases as we complete the parcels. We have secured enough exit sale commitments for phase 1 to proceed with signing the PSA for Parkside Place. We need to immediately place a Risk Mitigation Insurance Wrap with LLoyd's to satisfy our buyers risk requirement so they are protected when they release a portion of their purchase proceeds to allow us to close the purchase with the Boys and Girls Club. The total cost for this insurance wrap is $371,000 USD. As soon as the insurance wrap is in place we can go to PSA contracts with the following buyers for Phase 1.

Phase 1 closings will complete in 9 months.

Lot 1 and 2 - $27M discounted as a concession to $21.6M, they will release $5.4M for the closing.

Calpers (California Public Employees Retirement System) is taking the two student housing sites for the Seminole State College lease.

Lot 3 - $8.59M discounted as a concession to $6.87M, they will release $1.7M for the closing.

Wayne King (Syndicate) Marriott Hotel, and CBRE (commercial REIT clients) AMC expressed interest in the movie theaters.

Lot 4 and 5 - $17.33M discounted as a concession to $13.86M, they will release $3.4M for the closing.

CBRE (commercial REIT clients)

Lots 6, 7 and 8- $20.88M discounted to $16.7M, they will release $4.175M for the closing.

Toll Brothers (residential)

Lot 9 - $6.44M discounted to $5.15M, they will release $1.29M for the closing.

Lenar (residential)

Lot 18, 19, 20, 21 - $28.45M discounted to $22.76M, they will release $5.69M for the closing.

Toll Brothers (residential) and CBRE (commercial REIT clients)

Lot 22 - $12.28M discounted to $9.8M, they will release $2.45M for the closing.

Lenar (residential) and CBRE (commercial REIT clients)

Lot 23 $9.6M discounted to $7.68M, he will release $1.92M for the closing.

Ag Solutions

Lot 24 $10.0M discounted to $8.0M, he will release $2M for the closing.

ARP International (Thomas Hoefler)

Totals, Original Gross Ask, $140.57M

Total Contracts to execute $112.42M

Deposits released to us for closing $28.1M.

This Leaves TW with lots 10-17 free and clear and will NOT have to discount them to sell.

Total value as is $69.72m

Project Summary

Resources

"We are not legal or financial professionals, and therefore, we do not offer legal or financial advice. It is recommended that you seek guidance from your own legal counsel or financial advisors for any such matters."

Contact Us

Mon-Fri 9am-5pm

Marvin Miles, Consultant

866-860-1860

info@sourcecapitalconsulting.com

2022 All Rights Reserved.